American Trustee Health Plans

Affordable health care coverage with access to any doctor, any hospital, anywhere.

Make the move to a new brand of healthcare coverage with a more modern approach.

Why is Health Insurance so Expensive?

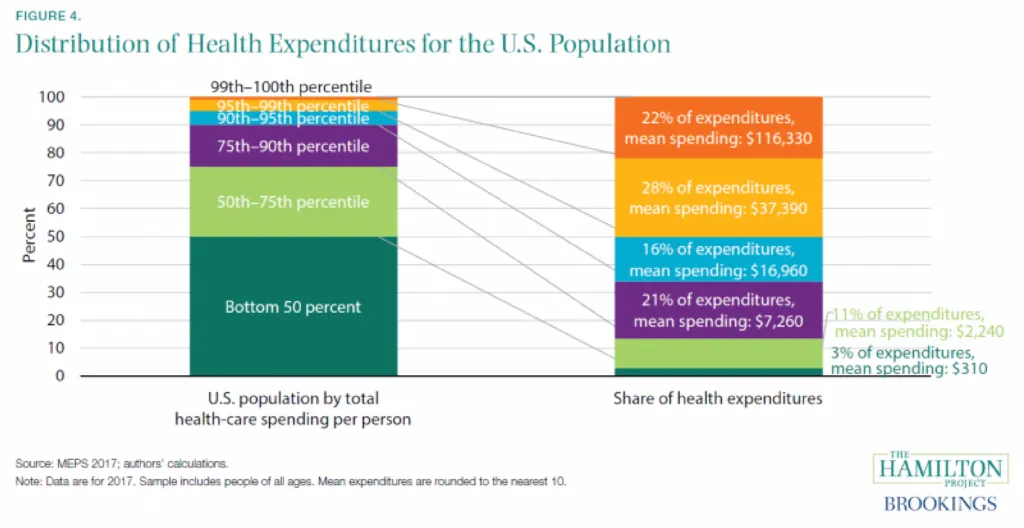

The escalating costs of healthcare can be attributed to a fundamental issue: a vast majority, approximately 90%, of individuals in good health find themselves footing the bills for the remaining 10% who account for more than 66% of total healthcare expenses. Unfortunately, the current healthcare system is not structured to provide equitable solutions for those who are relatively healthy. Take a look at the visual representation in the chart below for a clearer picture.

Innovation

With an innovative and creative outlook, we aim to revolutionize the way individuals access affordable healthcare coverage. Health insurance has changed dramatically over the last few years due to new legislation. However, many consumers are not aware of these changes and how to take advantage of them.

Consumer Protection

In 2020 the U.S. Congress passed the Transparency Pricing Act empowering consumers nationwide by requiring healthcare providers to disclose what they charge for their services. This mandate has enabled consumers to make informed decisions about their healthcare expenses and identify the most cost-effective providers while avoiding price gouging.

The Future is Here

This also caused forward-thinking insurers to develop creative plan designs emphasizing first-dollar coverage and minimize the burden of annual deductibles. This simply means that if you have routine healthcare needs such as lab work, x-rays or maybe an MRI, your health insurance company will bear the initial cost, sparing you from shouldering the financial burden up front.

With traditional major medical insurance, if you need routine medical care such as lab work, who typically pays for that service? Well, you do because you have an annual deductible to meet before your insurance begins to pay and the whole time you are paying an expensive premium for coverage you really cannot use unless you experience a catastrophic health event.

The Future is Here

This also caused forward-thinking insurers to develop creative plan designs emphasizing first-dollar coverage and minimize the burden of annual deductibles. This simply means that if you have routine healthcare needs such as lab work, x-rays or maybe an MRI, your health insurance company will bear the initial cost, sparing you from shouldering the financial burden up front.

With traditional major medical insurance, if you need routine medical care such as lab work, who typically pays for that service? Well, you do because you have an annual deductible to meet before your insurance begins to pay and the whole time you are paying an expensive premium for coverage you really cannot use unless you experience a catastrophic health event.

Your Savings

Due to this ingenious method of providing quality healthcare and reducing medical costs, these unique health plans typically come with a premium cost of approximately “half” that of a traditional major medical plan.

For more information and to learn how you can take advantage of this insightful way of receiving healthcare services, speak to an American Trustee Health Advisor today by requesting a quote or calling us at 1-800-958-8199.

American Trustee Financial Services is here to help.

American Trustee Financial Services is committed to producing the best outcomes. That is why we train and provide tools and resources for each and every agent. Book an appointment to find out for yourself what we can do for you.

Phone:

Address: 3033 NW 63rd Street St E-104, Oklahoma City, OK 73116

PO Box 21422 Oklahoma City, OK 73156

Fill out the form and we’ll reach out to you!

How can we reach you?

American Trustee Financial Services can help you invest in the health of your employees with group medical insurance. Book an appointment today to go over your options.

Phone:

Address: 3033 NW 63rd Street St E-104, Oklahoma City, OK 73116

PO Box 21422 Oklahoma City, OK 73156

Quick Links

© 2025 AmericanTrustee. All Rights Reserved.